Cadence Bank: Difference between revisions

No edit summary |

|||

| Line 1: | Line 1: | ||

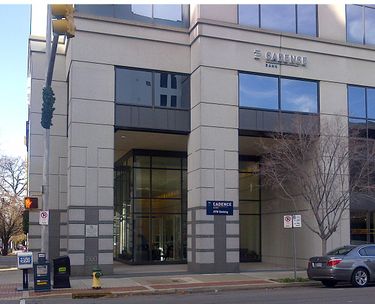

[[Image:Cadence_One_Concord.jpg|right|thumb|375px|Cadence Bank at Concord Center, December 2012]] | [[Image:Cadence_One_Concord.jpg|right|thumb|375px|Cadence Bank at Concord Center, December 2012]] | ||

'''Cadence Bank, N. A.''' is | '''Cadence Bank, N. A.''' is a Tupelo, Mississippi-based bank which is the sole operating unit of the Houston, Texas-based [[Cadence Bancorporation]]. From [[2011]] to [[2018]] the bank's headquarters offices were located in [[Birmingham]]. | ||

Cadence Bank traces its origins to the [[1889]] founding of the National Bank of Commerce in Starkville, Mississippi. As it grew into markets where similarly-named banks were already operating in the early 2000s, it adopted the Cadence Bank name. | Cadence Bank traces its origins to the [[1889]] founding of the National Bank of Commerce in Starkville, Mississippi. As it grew into markets where similarly-named banks were already operating in the early 2000s, it adopted the Cadence Bank name. | ||

In [[2010]] the United States Office of the Comptroller ordered Cadence Bank to raise its capital ratio. After missing the deadline and facing a takeover by the FDIC, Cadence negotiated its sale to the Trustmark Bank of Columbus, Mississippi. Before that deal was finalized, a higher offer was made by the Community Bancorp LLC of Houston, Texas. Its acquisition was completed in March 2011, at which time Community adopted the Cadence name. Cadence Bank was merged eight months later with Birmingham's failed [[Superior Bank]]. At the time of the merger, Cadence had 38 office in Mississippi, Alabama, Florida, Georgia and Tennessee. Its seven Alabama branches included five in [[Tuscaloosa]] and two in [[Hoover]]. Superior had 73 branches in Alabama and Florida, and was the second-leading mortgage lender in the Birmingham market. | In [[2010]] the United States Office of the Comptroller ordered Cadence Bank to raise its capital ratio. After missing the deadline and facing a takeover by the FDIC, Cadence negotiated its sale to the Trustmark Bank of Columbus, Mississippi. Before that deal was finalized, a higher offer was made by the [[Community Bancorp LLC]] of Houston, Texas. Its acquisition was completed in March 2011, at which time Community adopted the Cadence name. Cadence Bank was merged eight months later with Birmingham's failed [[Superior Bank]]. At the time of the merger, Cadence had 38 office in Mississippi, Alabama, Florida, Georgia and Tennessee. Its seven Alabama branches included five in [[Tuscaloosa]] and two in [[Hoover]]. Superior had 73 branches in Alabama and Florida, and was the second-leading mortgage lender in the Birmingham market. | ||

Superior CEO [[Sam Tortorici]] kept his position with the merged bank, which operated from Superior's offices in the [[John Hand building]]. When its lease expired in November [[2012]] it relocated to the [[Concord Center]]. In [[2014]] and [[2015]] Cadence Bank closed twenty-five branches and built its assets to over $8 billion. The holding company went public in April [[2017]]. | Superior CEO [[Sam Tortorici]] kept his position with the merged bank, which operated from Superior's offices in the [[John Hand building]]. When its lease expired in November [[2012]] it relocated to the [[Concord Center]]. In [[2014]] and [[2015]] Cadence Bank closed twenty-five branches and built its assets to over $8 billion. The holding company went public in April [[2017]]. | ||

Revision as of 12:35, 8 November 2021

Cadence Bank, N. A. is a Tupelo, Mississippi-based bank which is the sole operating unit of the Houston, Texas-based Cadence Bancorporation. From 2011 to 2018 the bank's headquarters offices were located in Birmingham.

Cadence Bank traces its origins to the 1889 founding of the National Bank of Commerce in Starkville, Mississippi. As it grew into markets where similarly-named banks were already operating in the early 2000s, it adopted the Cadence Bank name.

In 2010 the United States Office of the Comptroller ordered Cadence Bank to raise its capital ratio. After missing the deadline and facing a takeover by the FDIC, Cadence negotiated its sale to the Trustmark Bank of Columbus, Mississippi. Before that deal was finalized, a higher offer was made by the Community Bancorp LLC of Houston, Texas. Its acquisition was completed in March 2011, at which time Community adopted the Cadence name. Cadence Bank was merged eight months later with Birmingham's failed Superior Bank. At the time of the merger, Cadence had 38 office in Mississippi, Alabama, Florida, Georgia and Tennessee. Its seven Alabama branches included five in Tuscaloosa and two in Hoover. Superior had 73 branches in Alabama and Florida, and was the second-leading mortgage lender in the Birmingham market.

Superior CEO Sam Tortorici kept his position with the merged bank, which operated from Superior's offices in the John Hand building. When its lease expired in November 2012 it relocated to the Concord Center. In 2014 and 2015 Cadence Bank closed twenty-five branches and built its assets to over $8 billion. The holding company went public in April 2017.

In 2018 Cadence merged with State Bank Financial Corp. of Atlanta, Georgia. Tortorici remained CEO as the bank's headquarters offices relocated to Atlanta. in 2021 Cadence was acquired by BancorpSouth Bank, which adopted the Cadence name and split its headquarters offices between Tupelo, Mississippi and Houston, Texas.

Birmingham area locations

- Blountsville: 69156 Main Street

- Birmingham: Concord Center, 2100 3rd Avenue North

- Birmingham: Interactive drive-thru teller, 2301 3rd Avenue North

- Birmingham: Heritage Town Center, Woodland Park

- Childersburg: 33327 U.S. Highway 280

- Chelsea: 104 Chelsea Pointe Drive (closed 2015)

- Cleveland: 18045 Alabama Highway 160

- Gardendale: 2250 Mount Olive Road

- Greystone: 6801 Cahaba Valley Road

- Hoover: 2755 John Hawkins Parkway

- Mountain Brook: 2717 Culver Road, inside Western Supermarket (closed 2016)

- Mountain Brook: 1000 Jemison Lane inside Greenwise Market at Lane Parke, formerly Western (2016-)

- Northport: 3100 McFarland Boulevard West (closed 2015)

- Oneonta: 608 2nd Avenue East

- Pelham: 101 Huntley Parkway (closed 2015)

- Snead: 87615 U. S. Highway 278 in Altoona

- Sylacauga: 126 North Broadway Avenue

- Trussville: 1950 Edwards Lake Road

- Tuscaloosa: 6561 Highway 69 South, Hillcrest

- Tuscaloosa: 1101 Greensboro Avenue

- Tuscaloosa: 1121 Veterans Memorial Parkway, University Mall

- Warrior: 218 Louisa Street

References

- Rupinski, Patrick (October 7, 2010) "Cadence Bank accepts higher merger offer." Tuscaloosa News

- Hubbard, Russell (April 15, 2011) "Banking regulators seize Superior Bank and Nexity Financial Corp." The Birmingham News

- Hubbard, Russell (April 19, 2011) "Superior's new owner seeks more." The Birmingham News

- Hubbard, Russell (November 3, 2011) "Cadence Bank declines chance to buy John Hand Building, downtown Birmingham landmark." The Birmingham News

- Hubbard, Russell (August 2, 2012) "Cadence Bank moves to Concord Center." The Birmingham News

- Diel, Stan (October 24, 2012) "Cadence Bank sign to be placed atop downtown's Concord Center." The Birmingham News

- Seale, Michael (July 1, 2015) "Cadence Bank closes three Alabama branches." Birmingham Business Journal

- Coker, Angel (May 14, 2018) "Cadence Bank to move HQ from Birmingham to Atlanta." Birmingham Business Journal

External links

Cadence Bank website